The Small Business Owner's Guide to Credit Card Processing: Everything You Need to Succeed

- pete2728

- Nov 12, 2025

- 5 min read

Running a small business means juggling countless responsibilities, and payment processing shouldn't be one of your biggest headaches. Yet many business owners find themselves confused by fees, frustrated with slow funding, or worried about security breaches. The good news? Understanding credit card processing doesn't have to be complicated.

This guide breaks down everything you need to know about accepting credit cards, from choosing the right processor to maximizing your profits while keeping customers happy.

Why Credit Card Processing Matters More Than Ever

Your payment system is the bridge between your hard work and your revenue. When it works smoothly, you get paid faster, customers stay satisfied, and you can focus on growing your business instead of chasing down payments.

Recent industry data shows that businesses accepting credit cards see 18% higher average transaction values compared to cash-only establishments. Your customers expect payment flexibility, and providing it directly impacts your bottom line.

The speed of funding particularly matters for small businesses operating with tight cash flow. While traditional bank transfers can take 3-5 business days, modern processors offer next-day or even same-day funding options that keep your business moving forward.

How Credit Card Processing Actually Works

Understanding the process helps you make better decisions about processors and spot potential issues before they impact your business.

Every credit card transaction follows three essential stages:

Authorization happens in seconds. When a customer swipes, taps, or enters their card information, your system immediately contacts their bank to verify sufficient funds and check for fraud flags. The bank responds with either approval or decline.

Clearing occurs behind the scenes. Approved transactions get bundled and sent through the card networks (Visa, Mastercard, etc.) for verification. This step ensures all transaction details match between banks and processors.

Settlement completes the money transfer. Typically at the end of each business day, your processor groups all approved transactions and initiates fund transfers from customer banks to your merchant account.

This entire process happens automatically, but understanding it helps you troubleshoot issues and choose processors that optimize each stage for your specific business needs.

Choosing Your Credit Card Processor: The Decision That Impacts Everything

Your processor choice affects your costs, funding speed, customer experience, and daily operations. Here's how to evaluate your options strategically.

Start with your business model. Restaurant operations need different features than retail stores or service businesses. If you're running a salon, you'll want appointment booking integration. Restaurant owners need table management and tip handling. Mobile businesses require portable solutions that work anywhere.

Evaluate fee structures carefully. Most processors charge 1.5% to 3.5% per transaction, but the devil is in the details. Some charge monthly minimums, others add equipment rental fees, and many have hidden charges for basic features like customer support or statement access.

Consider integration capabilities. Your payment system should work seamlessly with your existing tools: inventory management, accounting software, customer relationship systems. The right processor eliminates double data entry and reduces errors.

Assess funding speed options. Standard funding takes 1-2 business days, but you can often pay for next-day or same-day funding if cash flow is critical to your operations.

Understanding the True Cost of Payment Processing

Processing fees are more complex than the headline rates processors advertise. Smart business owners look beyond the initial percentages to understand total costs.

Transaction fees form the base cost. These typically range from 1.5% to 3.5% depending on your business type, transaction volume, and risk profile. Card-present transactions (customers physically present) cost less than card-not-present transactions (phone or online orders).

Monthly fees add up quickly. Many processors charge monthly gateway fees, statement fees, account maintenance fees, and equipment rental costs. These can easily add $30-100 monthly to your processing costs.

Hidden fees create surprises. Chargeback fees, batch fees, voice authorization fees, and annual fees aren't always clearly disclosed upfront. Ask for a complete fee schedule before signing any agreements.

Dual pricing offers an alternative approach. This strategy allows you to offer cash discounts or add convenience fees for credit card usage, helping offset processing costs while remaining compliant with card network rules.

Setting Up Your Payment System for Success

The setup process determines how smoothly your payment operations run from day one. Don't rush through this crucial stage.

Choose the right hardware for your needs.Hardware options range from simple card readers to full POS systems with inventory management, employee tracking, and customer relationship features. Match your hardware to your business complexity and growth plans.

Plan for multiple payment methods. Modern customers expect options: credit cards, debit cards, contactless payments, mobile wallets, and even buy-now-pay-later services. Your system should handle all popular payment types without forcing customers to use only certain cards.

Optimize for your business environment.Mobile businesses need portable, battery-powered terminals. Retail locations benefit from countertop systems with customer-facing displays. Online businesses require secure payment gateways that integrate with their websites.

Test everything thoroughly. Process test transactions for each payment type you plan to accept. Verify that receipts print correctly, transactions settle properly, and your accounting systems receive accurate data.

Security: Protecting Your Business and Your Customers

Payment security isn't optional: it's essential for maintaining customer trust and avoiding costly data breaches that can destroy small businesses.

PCI compliance is mandatory. The Payment Card Industry Data Security Standard (PCI DSS) sets requirements for safely handling card data. Non-compliance can result in fines ranging from $5,000 to $100,000 monthly, plus increased processing fees.

Encryption protects data in transit. Modern payment terminals encrypt card data the moment it's swiped or entered, ensuring sensitive information never travels unprotected through your networks.

Tokenization adds another security layer. Instead of storing actual card numbers, secure systems replace them with meaningless tokens that can't be used by thieves even if stolen.

Regular updates prevent vulnerabilities. Keep all payment software and hardware updated with the latest security patches. Many processors provide automatic updates to ensure continuous protection.

Maximizing Your Processing Efficiency

Smart processing strategies can significantly impact your profitability and customer satisfaction.

Batch processing reduces fees. Most processors offer lower rates when you submit all daily transactions in a single batch rather than processing them individually throughout the day.

Address verification prevents fraud. For card-not-present transactions, always verify billing addresses and CVV codes. This reduces chargebacks and may qualify you for better processing rates.

Clear return policies prevent disputes. Well-communicated policies reduce chargebacks and customer confusion. Post policies prominently and train staff to explain them clearly.

Monitor transaction patterns. Unusual activity might indicate fraud attempts or processing issues. Quick identification prevents problems from escalating.

Common Pitfalls to Avoid

Learning from other business owners' mistakes can save you significant time and money.

Don't sign long-term contracts without escape clauses. Business needs change, and you shouldn't be locked into systems that no longer serve you. Look for month-to-month options or contracts with reasonable early termination terms.

Avoid processors that hold your funds. Some processors freeze merchant funds for extended periods, claiming security concerns. This can destroy small business cash flow. Choose processors with clear fund release policies.

Don't ignore statement details. Review monthly processing statements carefully. Hidden fees often appear gradually, and early detection prevents them from becoming expensive ongoing costs.

Resist the cheapest option automatically. Ultra-low rates often come with poor customer service, limited features, or surprise fees that make them more expensive than initially advertised.

Making Your Decision

Choosing the right payment processing solution requires balancing multiple factors: cost, features, security, and support quality. The best processor for your business depends on your specific needs, transaction volume, and growth plans.

Consider processors that offer transparent pricing, responsive customer support, and technology that grows with your business. Look for partners who understand your industry and can provide guidance beyond just processing transactions.

Your payment system should simplify operations, not complicate them. When evaluating options, prioritize solutions that integrate seamlessly with your existing workflows and provide clear, actionable reporting to help you make better business decisions.

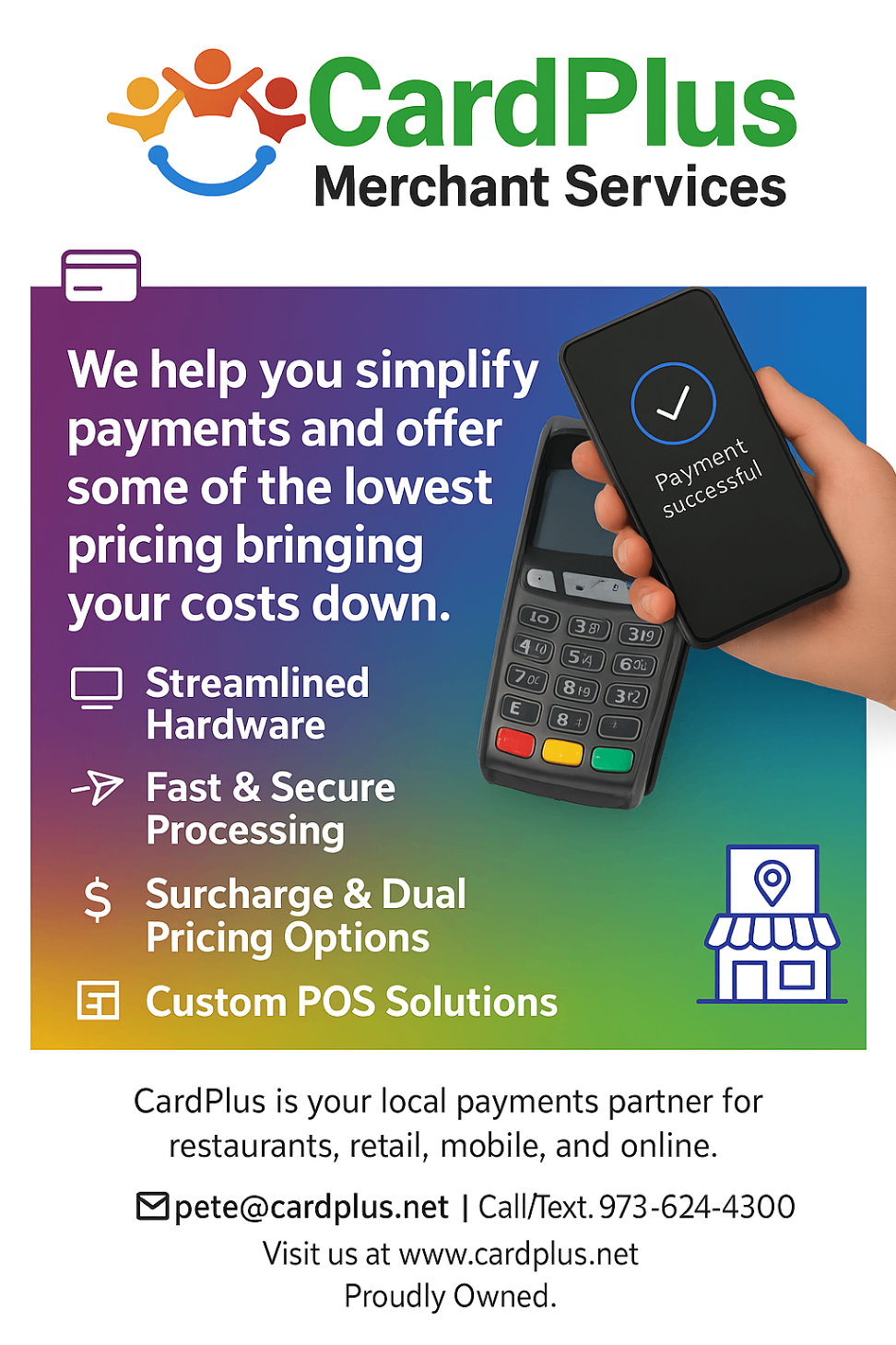

Ready to streamline your payment processing and start saving money on fees? Contact CardPlus today to discuss solutions tailored specifically for your business needs. Our local payment experts understand small business challenges and provide personalized support that helps you succeed.

Comments