New York's Credit Card Surcharge Law: How Disclosure Rules Impact Cash Discount Programs

- pete2728

- Nov 23, 2025

- 6 min read

If you're a small business owner in New York, you've probably heard about the state's new credit card surcharge law that took effect in February 2024. Maybe you're wondering if your current cash discount program is still legal, or if those "3% credit card fee" signs you see everywhere are actually compliant.

Here's the thing: this new law isn't just another regulatory hurdle: it's actually designed to protect both you and your customers while giving you more flexibility in how you handle processing fees. But (and this is important) only if you do it right.

Let's break down exactly what this law means for your business and how you can stay compliant while still saving money on those pesky processing fees.

What Changed in New York's Surcharge Laws?

For years, New York had a blanket ban on credit card surcharges. You simply couldn't charge customers extra for using a credit card: period. But after a Supreme Court ruling in 2017 that found these bans violated free speech rights, New York had to get creative.

Instead of keeping the outright ban, the state decided to allow surcharges with one major catch: complete price transparency. Assembly Bill 2672, which became law on February 11, 2024, says you can charge surcharges, but customers need to know exactly what they'll pay before they reach the checkout counter.

According to reporting from News12 and 14850.com, the law was specifically designed to prevent those surprise fees that frustrated customers and created unfair pricing practices.

The Two Non-Negotiable Requirements

The new law boils down to two simple rules that every New York business needs to follow:

Rule #1: Show the Real Price Upfront You must clearly display either the total credit card price (including any surcharge) OR both the cash price and credit card price together. No more hiding fees until the last second.

Rule #2: Don't Exceed Your Costs (and never over 3% on Visa/Mastercard) Your surcharge can't be higher than your actual processing cost. And for Visa and Mastercard credit card purchases, you cannot exceed a 3% surcharge under the latest network settlement terms. So if your effective cost is 2.6%, that's your max. If your cost is 3.2%, you must cap at 3%.

Network rule update (November 2025): Visa and Mastercard now allow merchants to impose surcharges on credit card transactions up to 3%, as reported by Morningstar and FSTech. These terms are subject to court approval and network rule updates, but the 3% ceiling is the operative cap for Visa/Mastercard credit today. Sources: Morningstar/MarketWatch and FSTech.

In New York, apply the stricter rule: your actual cost or 3%, whichever is lower. And you still have to meet the disclosure requirements in Rule #1.

Bottom line: you cannot exceed a 3% surcharge on Visa/Mastercard credit card purchases.

Here's what makes this tricky: you can't just put up a sign that says "add 3% for credit cards." You need to show the actual dollar amount customers will pay.

How This Affects Your Cash Discount Program

Now, here's where it gets interesting for businesses already running cash discount programs. The good news? Your program can absolutely still work under the new law. The key is in how you present your pricing.

What's Still Legal:

Displaying the higher credit card price prominently, then offering a discount for cash

Showing both prices side by side (cash price and credit card price)

Using the same price for both payment methods

What Will Get You Fined:

Only showing the cash price with a small note about credit card fees

Posting "cash price + 3% surcharge for cards" without showing the actual total

Any pricing display that doesn't clearly show what credit card users will actually pay

The difference might seem subtle, but it's crucial. Under the old approach, you might have advertised a $10 item with a note about credit card fees. Now, you need to either show "$10 cash / $10.30 credit" or just display "$10.30" with a cash discount available.

Why This Law Actually Helps Your Business

I know what you're thinking: more regulations, more headaches. But here's why this law might actually be good news for your business:

Customer Trust Increases When customers know exactly what they'll pay upfront, there are no surprises at checkout. This transparency builds trust and reduces those awkward moments when customers get frustrated about unexpected fees.

Level Playing Field Now every business in New York needs to follow the same disclosure rules. That competitor down the street who was hiding surcharges? They need to be just as transparent as you are.

Protection from Chargebacks Clear pricing disclosure protects you from customers who claim they weren't informed about surcharges. When the price is clearly posted, you have solid documentation.

Practical Steps to Stay Compliant

Getting your pricing displays compliant doesn't have to be complicated. Here's your action plan:

Update Your Signage Replace any signs that just mention percentage fees. Your new signs should show actual dollar amounts or clearly display both pricing options. If you surcharge, never indicate more than 3% on Visa/Mastercard credit.

Set a Hard 3% Cap in Your System Configure your POS to cap Visa/Mastercard credit surcharges at 3% and never above your actual effective processing cost. If your cost is lower than 3%, cap at your cost.

Train Your Staff Make sure everyone on your team understands the pricing structure and can explain it to customers if asked.

Review Your POS Settings Ensure your point-of-sale system displays prices correctly and calculates any surcharges accurately. Separate debit from credit: no credit-card surcharge on debit transactions.

Document Everything Keep records of your actual processing costs to justify your surcharge amounts if questioned. Save your signage proofs and POS configuration screenshots.

The Cost of Non-Compliance

This isn't just about good business practices: there are real penalties for getting it wrong. The law allows for civil penalties of up to $500 per violation, and local governments can enforce these penalties directly.

With busy restaurants processing hundreds of transactions during peak hours, or retail stores dealing with holiday rushes, these violations can add up quickly. A single busy day with improper pricing displays could result in multiple violations.

Smart Compliance Strategies for Different Business Types

Restaurants and Cafes Consider displaying both prices on your menu boards: "Cappuccino: $4.50 cash / $4.65 card." This approach is clear and lets customers choose their preferred payment method before ordering.

Retail Stores You might opt for the cash discount approach: display the credit card price on all items and train staff to mention cash discounts at checkout: "Your total is $25.50, or $25 if you pay cash."

Service Businesses For businesses that quote prices over the phone or in person, always clarify which price you're quoting: "That service is $150 if paying by credit card, or $145 cash."

Making the Transition Smooth

The key to implementing these changes successfully is communication. Let your regular customers know about the pricing structure changes and why they're happening. Most customers appreciate transparency, especially when you explain it's about compliance and fairness.

Consider using this transition as an opportunity to review your overall payment processing setup. Are you getting the best rates? Is your current provider helping you stay compliant with changing regulations? Sometimes regulatory changes like this one highlight areas where your payment processing could be more efficient.

Your Next Steps

Understanding the law is just the first step: implementing compliant solutions that work for your specific business is where the real value lies. Whether you want to implement a cash discount program, set up compliant surcharging, or just ensure your current practices meet the new requirements, having the right payment processing partner makes all the difference.

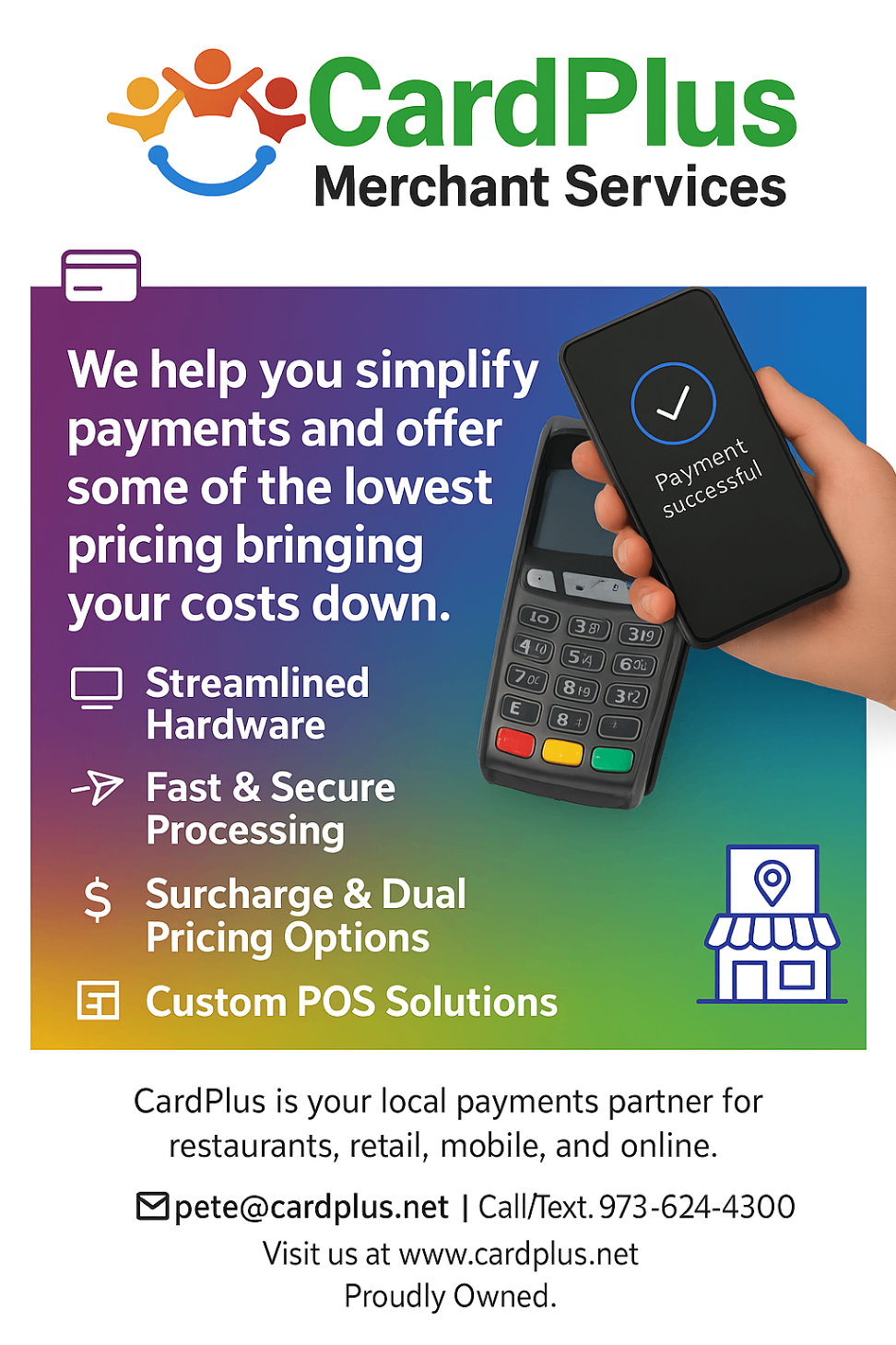

The team at CardPlus specializes in helping New York businesses navigate these exact compliance challenges while optimizing their payment processing costs. We can help you design pricing displays that meet legal requirements, configure POS systems for proper disclosure, and implement cost-effective payment solutions that work with the new regulations.

Don't let compliance concerns hold your business back from saving on processing fees. Contact CardPlus today to discuss how we can help you implement a compliant, profitable payment strategy that keeps both you and your customers happy.

The new law might seem complicated, but with the right approach and support, it's just another step toward running a more transparent, profitable business. And isn't that what we all want?

Comments